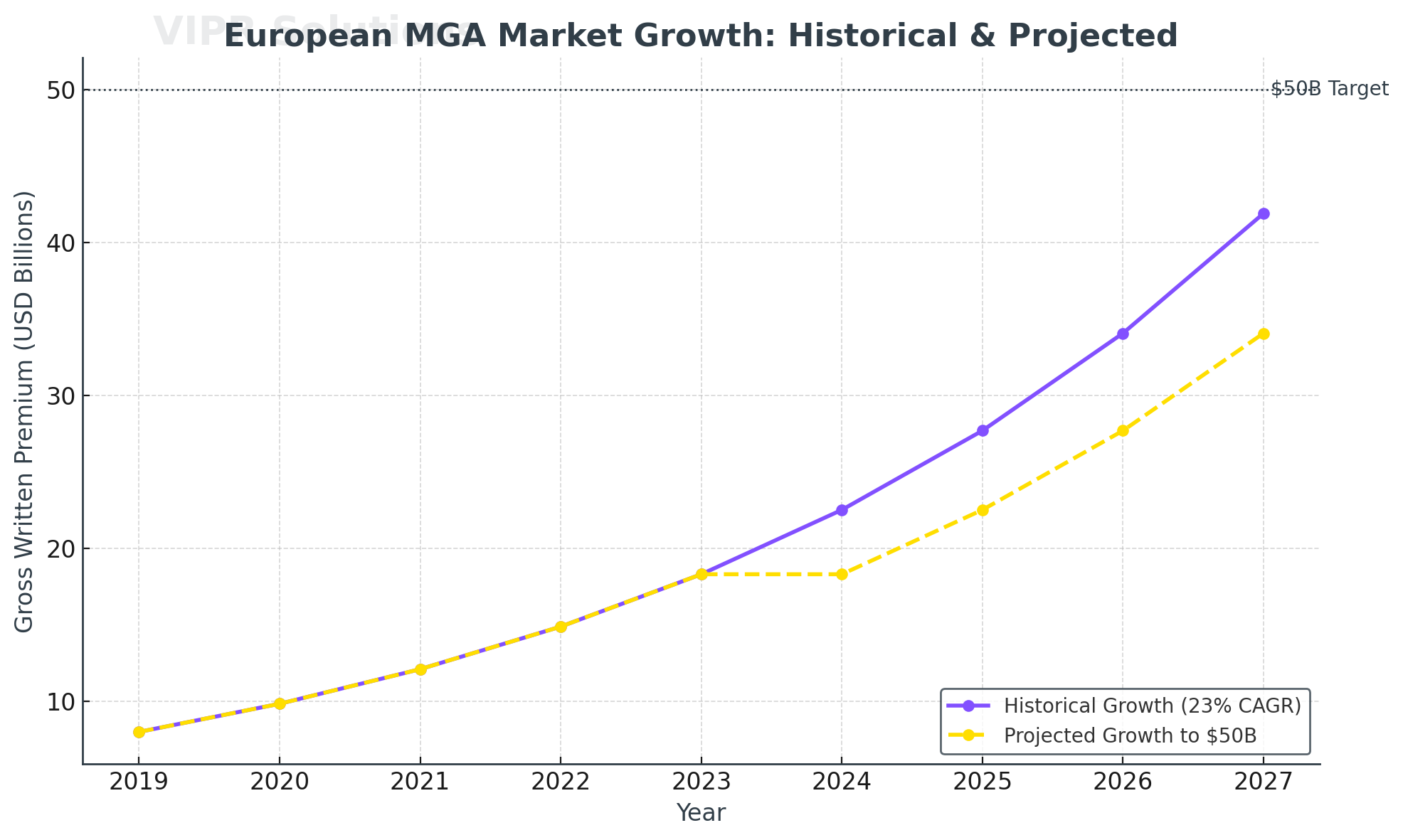

The numbers emerging from the European MGA landscape tell a compelling story. Howden Re's latest Agents of Change report reveals a market that has grown at over 23% annually since 2019, reaching an estimated $20 billion in gross written premium.

More striking still is the projection: this market could exceed $50 billion within the next three to four years.

The infrastructure reality behind the growth

Behind every successful MGA expansion lies a less glamorous but critical truth: operational infrastructure determines scalability. The MGAs thriving in this environment share common characteristics that extend far beyond their underwriting expertise.

They've recognised that deep market knowledge and niche specialisation - while essential - are no longer sufficient differentiators. The winners are those who've built operational foundations capable of supporting exponential growth without compromising data integrity or carrier relationships.

As Tony Russell, Chief Risk Officer at VIPR, observed during recent industry discussions:

"The pressure on MGAs to manage exponentially more data, across more channels, under increasing scrutiny, has created a new operational reality. Those who adapt thrive; those who don't become acquisition targets."

Three pillars of sustainable MGA growth

Data as a Strategic Asset The most successful MGAs treat data management as a core competency rather than an administrative burden. They understand that clean, validated, and accessible data directly impacts their ability to maintain carrier confidence and expand program capacity.

Operational maturity at speed Traditional insurers often mistake process complexity for thoroughness. Leading MGAs achieve the opposite: they streamline operations while maintaining rigorous standards. This isn't about cutting corners, it's about eliminating friction that doesn't add value.

Technology integration without disruption The smartest MGAs don't implement technology for its own sake. They focus on solutions that integrate seamlessly with existing workflows while providing clear operational improvements. The goal isn't to replace everything, it's to enhance what works and fix what doesn't.

The consolidation catalyst

Market growth of this magnitude inevitably attracts consolidation activity. For MGAs, this creates both opportunity and pressure. Those with robust operational infrastructure become attractive acquisition targets or merger partners. Those struggling with basic data management find themselves increasingly isolated.

The companies navigating this landscape successfully share a common approach: they've invested in systems that make due diligence straightforward and integration feasible.

Looking beyond the headlines

While the €50 billion projection captures attention, the real story lies in how European MGAs are redefining insurance operations. They're proving that agility and rigour aren't mutually exclusive, they're complementary forces that, when properly balanced, create sustainable competitive advantage.

The question for industry leaders isn't whether this growth will continue, the fundamentals suggest it will. The question is whether individual organisations have built the operational foundation necessary to participate in that growth meaningfully.

If you are not operationally mature, we can help you achieve that?