“I understand VIPR are talking to companies in the Australian market. As an ACORD member and working closing with our solutions group, I would be happy to talk to any prospect you may be working with

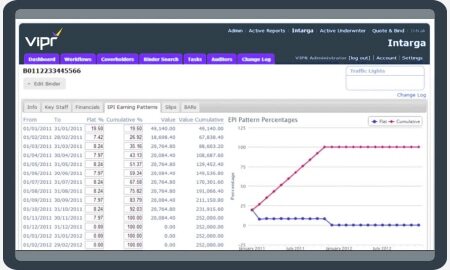

VIPR INTARGA

Workflow for Onboarding & Due Diligence

Managing onboarding and due diligence processes for third-party relationships in program business and delegated underwriting can be complex.

VIPR Intarga simplifies these processes with efficient workflows, ensuring regulatory compliance, saving time, and improving business performance. Tailored for MGUs, brokers, and carriers, VIPR Intarga is the number one solution selected by U.S. carriers.

VIPR Intarga combines the benefits out-of-the-box workflows with the flexibilty to build a process that is tailored for your business strategy.

VIPR Intarga provides all the tools you need to design due diligence and onboarding workflows, allowing you to capture all the information you need and store key documents. The intuitive workflow builder provides a drag-and-drop interface to build your own workflows, and the powerful features of the VIPR platform ensure that your workflows are secure, auditable and scalable.

Workflows can be configured to include SLAs, reminders, and escalations, and can be assigned to individuals or groups. The workflow builder also allows you to configure the data that is captured at each step and the documents that are required. This means that you can capture all the information you need, and ensure that all the relevant documents are stored in the right place.

Streamlined workflows mean that you can onboard new stakeholders faster, and reduce the time spent on due diligence. This means that you can focus on the things that matter, and provide a better service overall.

Why use VIPR Intarga for your onboarding and due diligence workflows?

-

It eliminates manual data entry and accelerates customer onboarding with workflow automation that captures and securely stores all essential information.

-

Custom Workflows for MGUs, Brokers, and Carriers with an intuitive drag-and-drop builder.

-

Stay compliant with evolving insurance regulations using secure, auditable workflows. Intarga helps you manage due diligence while task management features like SLAs and escalations ensure critical tasks are completed on time.

Case studies

-

-

-

With the introduction of new regulations by Lloyd’s, Advent recognised the need to understand the data they were receiving through bordereaux cleansing, validations and accurate reports. They also fel

-

“The implementation of Intarga, Intrali and Active Reports has enabled us to move from a paper driven process to an electronic solution within required timescales set-out at the start of the project.

-

Why choose VIPR? For Business Process As A Service (BPaaS)

-

Meridian Risk Solutions Ltd is a fully accredited independent Lloyd’s Broker, specialising in Marine, Hull, Cargo, Protection and Indemnity, Kidnap and Ransom, Energy, Property, Casualty, Delegated Un

-

-

MGAM selects VIPR’s Intarga alongside Intrali, Active Reports and Insurance Broking Accounts solutions to build processes that ensure excellent customer service

-

During 2018 Channel had created a new vision for effective bordereaux management and adjusted its model for data receipt, quality, reporting and analytics.

-

-

Oneglobal selects VIPR’s Intrali, Active Reports and VMS to accelerate renewals and data management

-

Why choose VIPR? Setting up a new business is never easy, but making the right decisions from the start, sets you up for success!

-

Why choose VIPR? To gain progressive, effective and efficient data insights.

-

Why choose VIPR? For best-in-class technology to accelerate new Canadian branch!

-

Why choose VIPR? Forward thinking data management, with future plans to seamlessly integrate data from bordereaux to real-time downstream data exchange through API flows

-

Specialty (re)insurer partners with VIPR to enhance data-driven decision-making through advanced technology and automation, revolutionizing their underwriting and reporting processes.

-

Why choose VIPR? To ensure you have a long-term partner to accelerate your business growth plans.

-

Streamline onboarding and due diligence in insurance with VIPR's Intarga, enhancing efficiency, security, and compliance for a seamless data management experience.

-

Why choose VIPR? To seamless fusion of Reinsurance, Blockchain Technology, and Alternative Capital Resources

-

Why choose VIPR? For platform compatibility. Effective platforms don’t operate in isolation.