“I understand VIPR are talking to companies in the Australian market. As an ACORD member and working closing with our solutions group, I would be happy to talk to any prospect you may be working with

VIPR PORTAL

THE VIPR DIGITAL GATEWAY

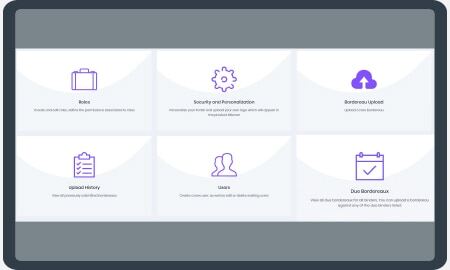

VIPR Portal is a single access point for third-parties to supply risk, premium and claims data to your organisation. Flexible connectors provide a range of ways to connect, including an intuitive user interface and API.

VIPR Portal gives third-parties (such as MGAs and DCAs) in delegated underwriting authorities (DUAs) a secure, single point of access to submit data to your organisation. The VIPR Portal can be used to replace existing manual submission processes, such as email and (S)FTP

Using the API capabilities, the solution provides the perfect platform for a seamless data transfer between systems, allowing you to connect to your existing systems and processes.

The VIPR Portal also provides the capability to feed back to data suppliers with details of any issues with their data submissions, allowing them to correct any errors and resubmit.

As the VIPR Portal is placed at the start of the data submission process, it is the ideal place to monitor data submission timeliness and data quality, giving a holistic view of third-party performance. It also provides the capability of straight-through processing, allowing you to automate the data submission process.

VIPR Portal is a multi-tenant SaaS platform and is fully integrated with the suite of VIPR products. It is also fully customisable to align with your individual company brand, providing a consistent brand experience to your clients across all touch-points.

Why use VIPR Portal?

- Secure data-sharing environment, keeping your information safe

- Straight-through processing, reducing manual intervention

- API connectivity, enabling real-time data transfer and an up-to-date view of risk, premium and claims data

Case studies

-

-

-

With the introduction of new regulations by Lloyd’s, Advent recognised the need to understand the data they were receiving through bordereaux cleansing, validations and accurate reports. They also fel

-

“The implementation of Intarga, Intrali and Active Reports has enabled us to move from a paper driven process to an electronic solution within required timescales set-out at the start of the project.

-

Why choose VIPR? For Business Process As A Service (BPaaS)

-

Meridian Risk Solutions Ltd is a fully accredited independent Lloyd’s Broker, specialising in Marine, Hull, Cargo, Protection and Indemnity, Kidnap and Ransom, Energy, Property, Casualty, Delegated Un

-

-

MGAM selects VIPR’s Intarga alongside Intrali, Active Reports and Insurance Broking Accounts solutions to build processes that ensure excellent customer service

-

During 2018 Channel had created a new vision for effective bordereaux management and adjusted its model for data receipt, quality, reporting and analytics.

-

-

Oneglobal selects VIPR’s Intrali, Active Reports and VMS to accelerate renewals and data management

-

Why choose VIPR? Setting up a new business is never easy, but making the right decisions from the start, sets you up for success!

-

Why choose VIPR? To gain progressive, effective and efficient data insights.

-

Why choose VIPR? For best-in-class technology to accelerate new Canadian branch!

-

Why choose VIPR? Forward thinking data management, with future plans to seamlessly integrate data from bordereaux to real-time downstream data exchange through API flows

-

Specialty (re)insurer partners with VIPR to enhance data-driven decision-making through advanced technology and automation, revolutionizing their underwriting and reporting processes.

-

Why choose VIPR? To ensure you have a long-term partner to accelerate your business growth plans.

-

Streamline onboarding and due diligence in insurance with VIPR's Intarga, enhancing efficiency, security, and compliance for a seamless data management experience.

-

Why choose VIPR? To seamless fusion of Reinsurance, Blockchain Technology, and Alternative Capital Resources

-

Why choose VIPR? For platform compatibility. Effective platforms don’t operate in isolation.